Sale-Leaseback Transactions in Commercial Real Estate

Learn the advantages and disadvantages of sale-leaseback transactions in commercial real estate, including potential tax benefits and cash flow improvements for buyers and sellers.

Sale-leaseback transactions are an increasingly popular strategy in commercial real estate, providing property owners a way to free up capital without sacrificing operational control of their properties. Whether you’re a business owner looking to improve liquidity or an investor seeking stable returns, it’s important to understand the benefits and risks of sale-leaseback transactions.

What is a Sale-Leaseback?

A sale-leaseback transaction occurs when a commercial property owner sells their property to an investor and then leases it back.

How It Works

Seller (now Tenant) gains access to capital by selling the property but continues to occupy the building through a lease agreement. The Buyer (now Landlord) purchases the property with a stable tenant in place.

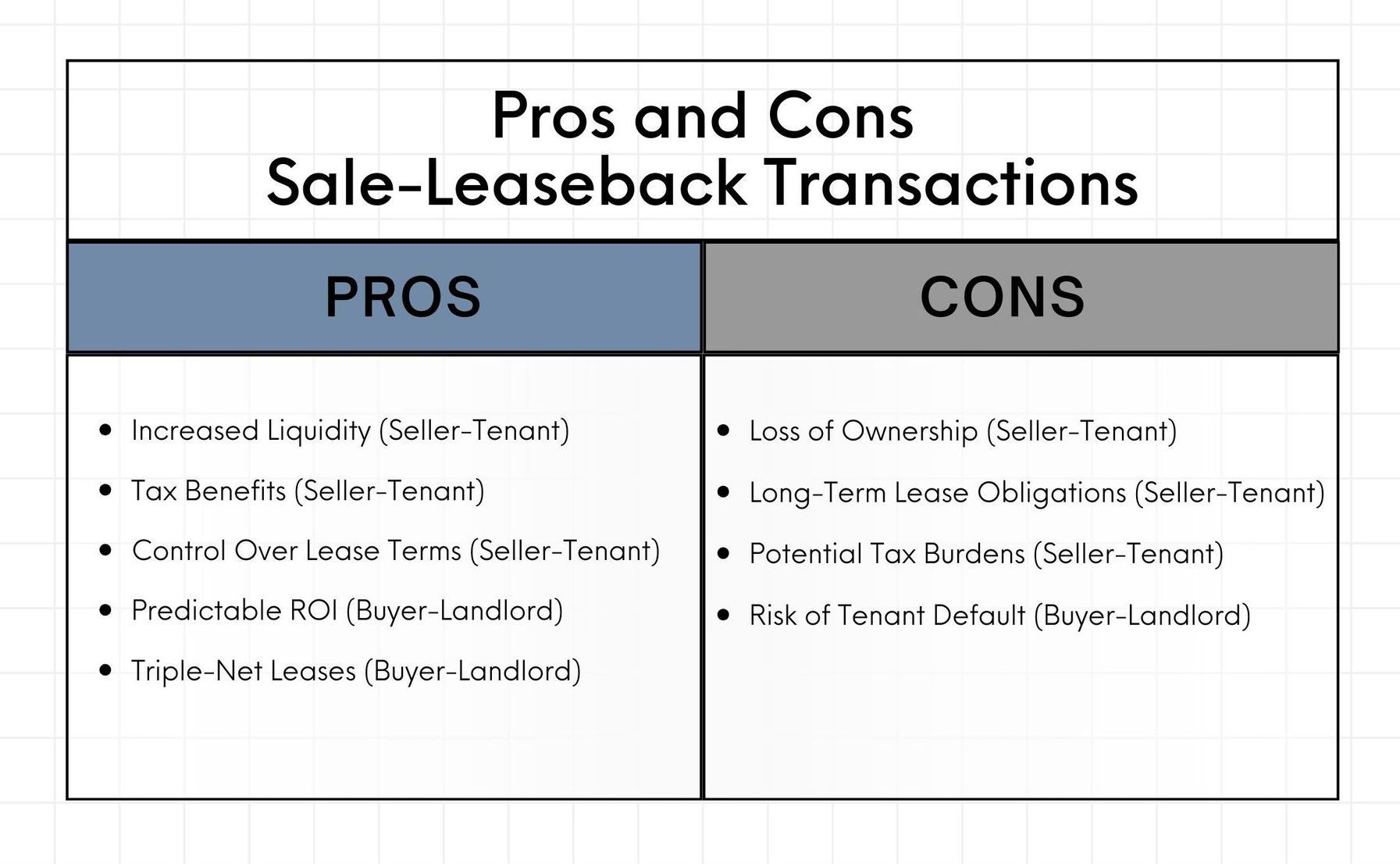

Pros of Sale-Leaseback Transactions

1. Seller gains access to equity in property

For businesses needing capital to reinvest or expand, a sale-leaseback offers an immediate cash infusion without taking on new debt and frees up capital that can be used for growth and enhances their debt-to-equity ratio.

2. Tax Benefits for Seller

Sale-leaseback transactions can offer significant tax benefits to the Seller. Upon selling the property and becoming the Tenant, lease payments become deductible as a business expense. If the property was fully depreciated, the Seller can now benefit from these deductions, improving their bottom line.

3. Seller has Control Over Lease Terms

Sellers retain effective control over the property by negotiating favorable lease terms. This flexibility allows them to secure long-term occupancy without tying up their financial resources in property ownership.

4. Predictable ROI for Buyer

For buyers, sale-leasebacks provide a relatively low-risk commercial investment opportunity. With a long-term lease in place, the Buyer has a predictable return on investment (ROI) and may benefit from tax advantages such as depreciation deductions and investment tax credits.

5. Triple-Net Leases Possible for Buyer

Many sale-leaseback agreements are structured as triple-net leases, which shift the responsibility for property taxes, maintenance, and insurance onto the tenant. This reduces the operational expenses and oversight of the investment for the Buyer.

Cons of Sale-Leaseback Transactions

1. Loss of Ownership for Seller

While the Seller maintains possession of the property, they lose out on future appreciation of the asset when they give up ownership. At the end of the lease term, the Seller will either need to negotiate a new lease, repurchase the property, or move operations elsewhere.

2. Long-Term Lease Obligations for Seller

Once a sale-leaseback is executed, the Seller is locked into a lease agreement for an extended period of time. If market conditions change or their business falls on hard times, the tenant could be stuck paying higher rent than they can afford.

3. Potential Tax Burdens for Seller

Tax implications can be positive or negative, depending on each unique scenario. Depending on how long the Seller has owned the asset, they may face significant capital gains taxes upon selling.

4. Risk of Tenant Default

The primary risk for any Buyer is tenant default. If the Seller becomes the tenant but fails to meet lease obligations, the Buyer may need to renegotiate the lease or find a new tenant, which could be time-consuming and costly.

If you’re interested in learning more about a sale-leaseback for your business or investment needs, Atlas Real Estate Advisors can provide you with a thorough analysis and provide expert guidance. Contact us today to learn more about this strategic option.