News

Investment Metrics: Cap Rate, IRR, and ROI Atlas Real Estate Advisors / November 14, 2025

When evaluating investment opportunities—especially in real estate or longer-term projects—knowing how to interpret key metrics is critical. Cap rate, IRR, and ROI each give you a different lens through which to view a deal’s attractiveness and risks. Below is a breakdown to help demystify…

Read more

Data Centers in Georgia: A Digital Infrastructure Boom Atlas Real Estate Advisors / October 17, 2025

Over the past decade, Georgia has become a significant hub for data center development in the United States. This has been driven by the increasing demand for digital infrastructure to support cloud computing, artificial intelligence (AI), and other data-intensive technologies. As of 2025, Georgia…

Read more

How Banks Underwrite Commercial Real Estate Loans Atlas Real Estate Advisors / September 10, 2025

As we step into 2025, the commercial real estate (CRE) lending landscape is evolving—marked by stabilized interest rates and a resurgence in financing activity. But behind every loan decision lies a rigorous underwriting process that determines whether a deal goes through. Underwriting: A Three-Dimensional…

Read more

Opportunity Zones: Navigating the “One Big Beautiful Bill Act” Atlas Real Estate Advisors / September 8, 2025

On July 4, 2025, President Trump signed the "One Big Beautiful Bill Act" (OBBBA), which makes the Opportunity Zone (OZ) tax incentives permanent and introduces a suite of strategic updates. Originally part of the Tax Cuts and Jobs Act of 2017, the OZ framework—which…

Read more

Commercial Market Momentum in Georgia Atlas Real Estate Advisors / August 8, 2025

Midway through 2025, the Georgia commercial real estate market is gaining traction—and investors in markets like Athens and Northeast Georgia are in a strong position to capitalize on this momentum. According to the June 2025 Capital Markets Compass by Colliers, transaction activity is rising…

Read more

Look for Opportunities in Retail Atlas Real Estate Advisors / June 1, 2025

Steady demand, combined with limited new supply, is contributing to the upward trend in retail real estate. New construction projects are being delayed due to higher interest rates and rising material costs, and many have been put on hold altogether. The limited new supply…

Read more

How Tariffs Impact Commercial Real Estate Atlas Real Estate Advisors / April 17, 2025

Ongoing trade disputes have dominated headlines in recent months, potentially reshaping key industries such as steel, lumber, and manufactured goods. While much of the discussion focuses on business costs and consumer pricing, the impact extends far beyond those sectors. Developers Should Anticipate Higher Costs…

Read more

Lease Administration Services Offered by Atlas Management Atlas Real Estate Advisors / April 4, 2025

For organizations with multiple locations or limited internal resources, outsourcing lease administration can be a game-changer. Does your business operate in multiple locations, each with its own lease? Who is overseeing them—tracking critical dates, coordinating renewals and terminations, and ensuring compliance? Do you have…

Read more

80 Years of Georgia Ports Atlas Real Estate Advisors / March 19, 2025

This year the Georgia Ports Authority (GPA) celebrates 80 years of fostering global trade and economic prosperity. History Georgia's ports date back to 1733, when General James Oglethorpe founded Savannah. The colony quickly became a major exporter of cotton and rice, with Savannah emerging as…

Read more

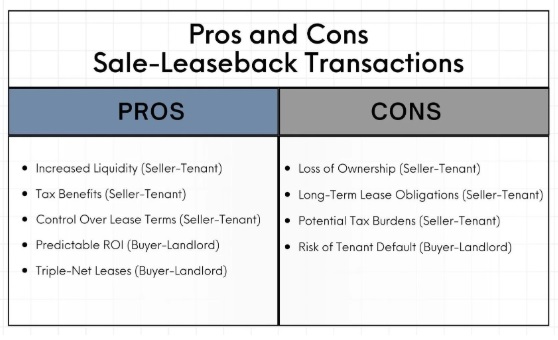

What is a Sale-Leaseback? Atlas Real Estate Advisors / January 26, 2025

Sale-leaseback transactions are an increasingly popular strategy in commercial real estate, providing property owners a way to free up capital without sacrificing operational control of their properties. Whether you’re a business owner looking to improve liquidity or an investor seeking stable returns, it’s important…

Read more

Welcome Jim Purcell to the Atlas Team! Atlas Real Estate Advisors / January 3, 2025

Atlas Real Estate Advisors is proud to announce that Jim Purcell has joined the team. Jim Purcell, an industry veteran with over 25 years of experience in banking and finance and more than a decade in real estate, has joined the Atlas Real Estate…

Read more

2024 Trends in Commercial Real Estate in GA Atlas Real Estate Advisors / November 14, 2024

The commercial real estate (CRE) market is undergoing significant changes in 2024, driven by various economic, technological, and societal factors. Here are some of the key trends shaping the landscape and how Atlas can help. High Interest Rates Interest rates have remained elevated, creating…

Read more

Understanding the Corporate Transparency Act (CTA) Atlas Real Estate Advisors / October 7, 2023

The Corporate Transparency Act (CTA) was passed in 2021 but goes into effect in 2024. It signifies a pivotal shift in the regulatory landscape, bringing about heightened transparency in corporate structures and operations within the United States. For commercial real estate investors, understanding the…

Read more

1031 Tax Deferred Exchange Oddities Atlas Real Estate Advisors / September 14, 2023

1031 exchanges offer more than just tax deferral; they can be integral to strategic planning, whether you're navigating a failed exchange, considering a reverse exchange, or planning for the future. Understanding these tools and how they fit into your broader investment strategy is crucial.…

Read more

Off Market Sale – Falls of Oconee Atlas Real Estate Advisors / June 14, 2022

Perhaps the most noticeable difference in commercial real estate compared to residential, is that many transactions are never really 'on the market'- or placed in the MLS or similar online site. Many of the deals we put together are a result of staying in…

Read more

Atlas Brokers Largest Sale in Clarke County Atlas Real Estate Advisors / October 1, 2021

On September 8th, 2021, Matt Thomas, President of Atlas Real Estate Advisors, brokered the sale of 106 units at The Preserve Condominiums to TBR Preserve Owner LLC of Atlanta for a total sales price of $22,700,000. The Preserve was initially developed in 2006…

Read more

Real Estate Advisor vs Broker: What’s the Difference? Atlas Real Estate Advisors / February 3, 2019

We are frequently asked what makes Atlas Real Estate Advisors different from a “normal” real estate brokerage. The short answer is an advisor can offer services that often fall outside the scope of buyer/seller and tenant/landlord representation. The long answer is that good advice…

Read more

Pros & Cons of LLC’s Atlas Real Estate Advisors / December 16, 2018

Utilizing a Limited Liability Company (LLC) for commercial property ownership offers numerous advantages, such as asset protection, tax benefits, and management flexibility. However, there are potential drawbacks and challenges as well. In this comprehensive guide, we explore both the pros and cons, providing you…

Read more

Atlas on the Move – Our New Address Atlas Real Estate Advisors / March 14, 2018

We have owned the commercial units downtown in The Georgian for years, and it's served us well as the main office for Atlas Real Estate Advisors. It was close to most of the businesses we already worked with, was surrounded by fabulous restaurants for…

Read more

Leave Us a Google Review! Atlas Real Estate Advisors / November 10, 2017

If you’ve used Atlas Real Estate Advisors or any of the associates and were satisfied with the service received, would you please take just a second to give us a 5-star review on Google? It’s easy to do – just click here: goo.gl/t7dHU9 Thank you…

Read more

Benefits of Hiring a Property Manager Atlas Real Estate Advisors / June 13, 2017

Property management services are ideal for out-of-state owners or large investors; however, the value of a property management service is not contingent upon the size or location of your real estate portfolio. You can add value to your investment by hiring a property manager…

Read more

Athens Area Urology Relocation Project Atlas Real Estate Advisors / January 16, 2022

Athens Area Urology is on the move! When considering a new location Athens Area Urology had a tight geographic ring with which to work since they needed to be close enough to the hospitals and surgery centers in order to see patients with little disruption to…

Read more

Kyle Nelson Joins Atlas Real Estate Advisors in Commercial Role Atlas Real Estate Advisors / September 1, 2020

Atlas is pleased to announce the addition of Kyle Nelson to the team. Kyle will serve as a commercial real estate specialist focused on Athens GA and the southeast. In addition to brokerage, Kyle is uniquely positioned to assist clients with development and project management. Prior…

Read more

Atlas Real Estate Advisors is Now Licensed in N.C.! Atlas Real Estate Advisors / November 27, 2017

Atlas Real Estate Advisors is now licensed to perform commercial real estate brokerage in the state of North Carolina. To serve our clients growing needs, Atlas is expanding by adding licenses across the Southeast U.S.

Read more

Atlas named to Bulldog 100 Atlas Real Estate Advisors / December 23, 2013

Atlas Real Estate Advisors was recognized as one of the top 100 fastest growing businesses owned or operated by a University of Georgia graduate during the 2014 Bulldog 100 Celebration on January 25 at the Marriott Marquis in downtown Atlanta. Atlas Real Estate Advisors,…

Read more

Experience the Atlas Real Estate Advisors difference.

Contact us today for personalized, expert advice in commercial real estate.

Let us help you navigate your real estate journey with confidence and success